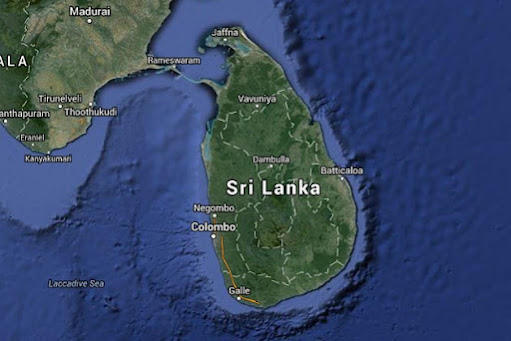

Is India Losing Sri Lanka?

The Sri Lankan government recently announced its decision to close diplomatic missions in the three countries in a bid to cut spending on overseas operations. The decision highlights Sri Lanka's deteriorating economic situation and the plight of foreign currency reserves. The outbreak of the corona, the decline in the influx of foreign tourists and the funding from foreign nationals are said to be the reasons behind this situation. Apart from these factors, the mountain of debt on the Sri Lankan economy and the exorbitant interest rates of Chinese banks also poses a major challenge to Sri Lanka's debt repayment. This is the root cause of the current situation. At the very last moment, China has joined hands with the Sri Lankan government for currency exchange, and China's efforts to strengthen its grip on the country in the name of keeping the economy afloat are evident.

Many countries are watching the developments in Sri Lanka, which

is strategically important in the Indian Ocean. In particular, China has

systematically strengthened its grip on Sri Lanka over the past two decades.

Sri Lanka is one of the first countries to get into debt with China. That is

why there are serious concerns about infrastructure projects and China's plans.

The current situation in Sri Lanka has to be seen in terms of China's debt

trap. Sri Lanka has a GDP of about 81 billion USD. The country's economy is

dependent on agriculture, tourism and foreign funding. After defeating the Tamil

rebels, China strengthened its grip on the country during the tenure of the

then Mahinda Rajapaksa. There they lent billions of dollars in the name of

developing infrastructure. Sri Lanka's debt has now risen to 26 billion USD.

So, every year the Sri Lankan government has to pay four to five billion USD

for the interest and repayment of the loan. With interest rates on loans from

Chinese banks for various projects ranging from four to six per cent, the Sri

Lankan economy has been hit hard by interest rates.

As debt mounts, the situation in the last two years poses an

even greater challenge to the local economy. Terrorists initially bombed the

church in April 2019. Therefore, foreign tourists avoid visiting Sri Lanka.

While the situation was recovering from that, the tourism sector was hit by the

outbreak of Corona. Tourism accounts for 10% of Sri Lanka's economy. In three

years, the number of foreign tourists dropped by 70 per cent, leaving them with

no foreign exchange. Revenue from tourism, which was 4.3 billion USD in 2018,

has come down to 925 million USD in the first nine months of 2021. Remittance

from citizens living abroad, on the other hand, is another major source of

foreign exchange; However, during the Corona and accompanying lockdowns, these citizens

were hit hard and their funding was cut off. Gotabaya Rajapaksa came to power

in 2019. At that time, the foreign exchange reserves in Sri Lanka's central

bank were 7.5 billion USD, which is now down to 1.58 billion USD. This shows

the effect on the foreign currency reserves.

The outbreak of the corona also put limits on Sri Lankan

exports. China and the European Union are Sri Lanka's major export hubs.

Initially, the prevalence of corona in Sri Lanka was limited. But, in China and

Europe situation was too bad. As a result, exports from Sri Lanka declined, and

foreign exchange-government revenue declined. The textile industry had to be

shut down for several months. The local government has made several efforts to

stem the tide of foreign influx. Foreign exchange was declining among all

banks. Banks were ordered to deposit 25 per cent foreign currency with the

government. Earlier this proportion was up to ten per cent. Since the country

is dependent on other countries for sugar, pulses and medicines, there is no

alternative to importing these items. Also, suddenly announced to give priority

to organic farming. This included restrictions on imports of chemical

agricultural products. Organic farming did not yield the expected yield and

food shortages ensued. Eventually, the government had to reverse the decision.

The central bank sought to maintain liquidity in the economy. For this, 800

billion rupees notes were printed. Tried to withdraw bonds; However, it does

not appear to have benefited much.

Now the government is taking steps to reduce financial costs. It has decided to close diplomatic missions in Nigeria, Germany and Cyprus. Opposition groups called for a loan from the International Monetary Fund (IMF). India also made efforts for currency exchange. However, China extended a helping hand. Of this, Sri Lanka's foreign exchange reserves will increase to 3.1 billion USD. Out of this, the Sri Lankan government is trying to improve its debt repayments and the standards it has received from financial institutions. Looking at the history and the mountain of debt so far, it is very challenging for Sri Lanka to get out of this vicious cycle and the fear of Sri Lanka reaching the second stage of China's debt crisis is becoming more apparent.

Comments